- Financial services operating on a local scale need local SEO (Search Engine Optimization) to get to the top of Google Maps and search engine results pages (SERPs).

- Local SEO is a set of digital marketing strategies that includes keyword optimization, reputation management, and business listing management.

- Semrush Local provides tools to help financial services businesses with their local SEO efforts.

Why is local SEO essential for financial services?

Whether you’re in accounting, mortgage lending, or insurance, you can (and should) leverage local SEO to make your business stand out among competitors. In fact, a wide range of financial businesses rely heavily on local SEO to promote their services, to build their online reputation, and to attract new clients within their geographic area.

The list of financial services business includes:

- Local branches of retail banks that serve the everyday banking needs of individuals and small businesses;

- Credit unions, member-owned financial cooperatives that provide banking services within specific local communities;

- Community banks, smaller, for-profit financial institutions that tailor their banking services to support local businesses and initiatives;

- Microfinance institutions, organizations offering small loans and other financial services within local communities, particularly in developing regions;

- Savings and loan associations whose focus is on accepting savings deposits and making mortgage and other loans;

- Real estate brokers helping individuals and companies to buy, sell, or rent properties;

- Mortgage lenders that provide home loans to individuals;

- Local insurance agents who sell various types of insurance policies to families and businesses;

- Financial planners, independent advisors who help clients manage their day-to-day expenses, achieve their financial goals, and plan for the future;

- Local firms that offer wealth management and investment advisory services to residents within a particular area;

- Bookkeeping firms tracking invoices and payments for smaller companies and freelancers,

- And accounting firms that provide more comprehensive financial reporting, tax preparation, and auditing services to local businesses.

These financial services providers may be diverse, but they have a few things in common. By optimizing their websites and Google Business Profiles (GBP) for local search, they can make it to the forefront of local search and Google Maps results, so new clients can find and contact them easily. Google ranks local search results based on distance, relevance, and prominence. That is, in addition to being nearby, financial services businesses rank higher if their GBP and website closely match the search terms, and if they are deemed trustworthy by the search engine. To meet Google’s criteria, financial services providers must adopt these local SEO strategies:

- Claiming and fine-tuning their Google Business Profile listings;

- Ensuring their NAP (Name, Address, Phone Number) data is consistent across online directories;

- Soliciting and managing online reviews;

- Creating location-specific content;

- Optimizing for local keywords;

- Building local backlinks.

Florida has many credit unions, and competition is high.

Why financial services businesses struggle with local SEO, and how to turn that around

Another thing financial services providers have in common is the challenges they face when it comes to local SEO. Strict regulations, stiff competition, and seasonality, among others, make it more difficult for these types of businesses to succeed through local SEO. Here are some of their top concerns, along with actionable strategies to cope with them.

Intense competition among major players

Local financial services, especially those in the banking, insurance, or real estate sector, have to compete with the local branches of national institutions. To retain a competitive edge, they must differentiate their services on a local level, which requires a sophisticated and nuanced SEO approach.

If you also feel cornered by national-level heavyweights, try creating solid content with relevant keywords to hold your own. In your blog and social media posts, describe your company’s involvement with the local community. Emphasize your thorough knowledge of the neighborhood and its residents and the personalized services that distinguish your business from the cookie-cutter offerings of big brands.

Use success stories and client testimonials to demonstrate the positive impact of your services on a local scale. For instance, if your financial services firm team regularly volunteers at neighborhood cleanups, or has a deep understanding of a local issue pertinent to your expertise, documenting and sharing these stories could boost your position on the local market.

A local bank in Florida highlights its community involvement with web content.

Difficult keywords

Keywords for various financial services are highly competitive and often dominated by large national players. For your local business, it might be a tall order to rank for these high-volume search terms. In addition, certain financial terms and phrases may be subject to regulation, and using these incorrectly could result in compliance issues.

Optimizing for the right keywords makes all the difference. Consider the specific services you offer, whether they be retirement planning, behavioral finance coaching, or budgeting and forecasting. Build your content and your business description in your GBP around these phrases. Remember, more precise, long-tail keywords tend to be less competitive than mass-volume generic ones. In line with the previous point, it’s also a good idea to use location-specific keywords that combine references to your geographic area with your professional focus.

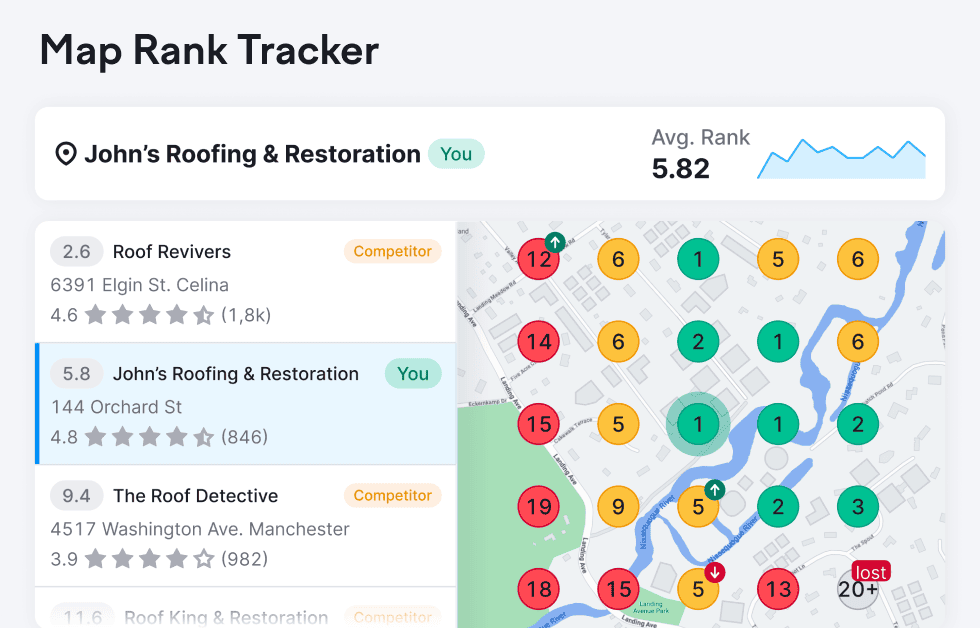

Visualize success: Semrush Local’s Map Rank Tracker tool helps you generate a chart of your company’s Google Maps rankings in various points of your vicinity for the keywords of your choice.

Sensitivity to reputation issues

In the financial sector perhaps more than elsewhere, negative reviews can put a significant dent in the credibility of a business, and thus its search ranking. If you’re a financial advisor, for instance, the opinion of even one disgruntled client can make prospects reconsider whom to turn to for advice on handling their money. Therefore, managing online reputation is more critical and complex than in other local industries.

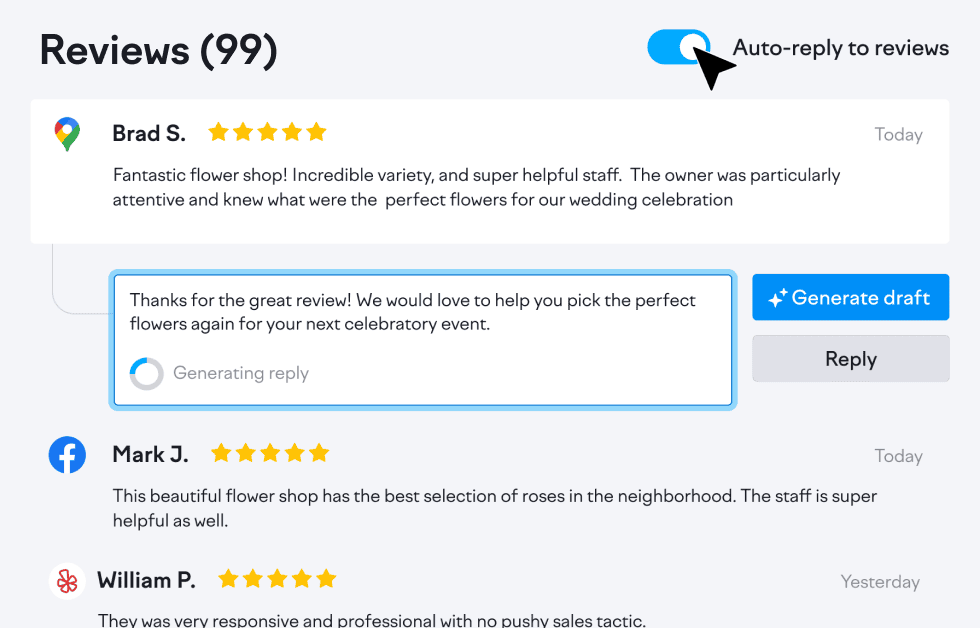

The sheer volume of reviews is the sign of an established business, so be sure to ask every client to rate your services on your GBP or other authoritative review sites. Then, respond to all reviews, promptly and professionally. Express your appreciation for positive ones. If you can find a way to defuse negative reviews by clarifying the situation or proposing a solution to the issues raised, this can help to redeem your reputation in the eyes of potential clients. Remember that financial institutions also have specific marketing regulations they must abide by according to jurisdiction. For example, “cherry-picking,” as in only asking a few of your core clients for reviews, will get you in trouble in the US, and a comprehensive method of obtaining reviews from all your clients must be carried out, according to Comply.

Google reviews from a bank location in Maryland

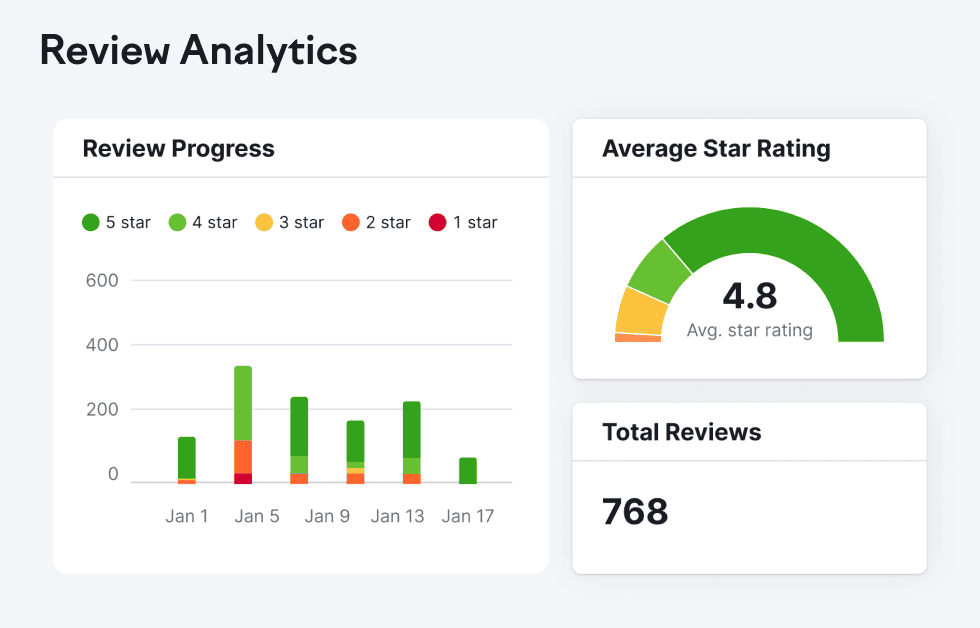

Convenient shortcut: Semrush Local’s Review Management tool enables you to see all your reviews from various sites at a glance, and assists you in generating responses to Google reviews using AI.

Fragmented digital presence

Many local financial services businesses, such as insurance or banks, are spread out across several branches or individual agents, all of whom have separate listings and profiles online. However, for ideal results, their local SEO activities need to be coherent, which is a bit of a challenge in such a fragmented setup.

If your business is also struggling with an inconsistent online presence, first decide whether it’s individual agents’ search rankings you aim to boost with local SEO, or that of the company as a whole. Consider also your site structure and the development of local pages when deciding this matter. In either case, revert to their or your GBP as the base: ensure it is optimized for relevant keywords, with accurate business information and high-quality images. Regularly update the GBP profile with posts about services and upcoming events or promotions. Then also proceed to create relevant content on your website where necessary to achieve your local business goals.

Beat writer’s block: Need a concise, SEO-friendly business description for your GBP page? Fire up this free AI Business Description Generator by Semrush.

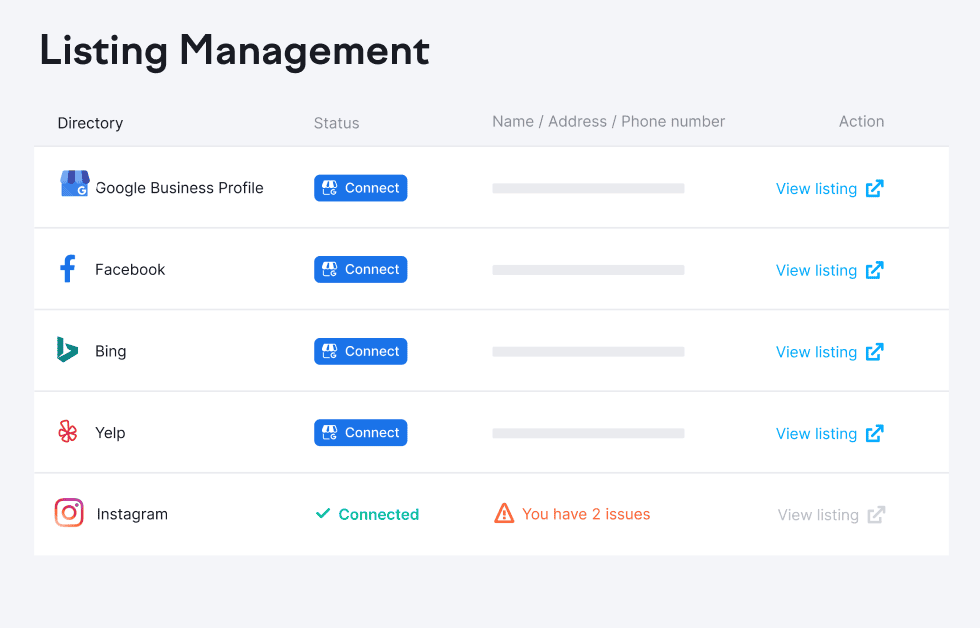

Save time: Semrush Local’s Listing Management tool takes the hassle out of updating your NAP data across various online directories by automatically distributing this information from your central dashboard.

Trust and authority requirements

In order to earn the trust of potential clients, financial services businesses need to establish a high level of authority. To prove their expertise, they must provide accurate and up-to-date information about their products and services. This can be more difficult than in other local industries, because the technical terms tend to be complex, requiring detailed explanation.

Creating SEO-friendly content that simplifies the offerings of various financial services providers while remaining valid and compliant demands time and expertise. Smaller financial businesses may lack these resources and struggle to produce the volume and quality of content needed to build trust and to improve local SEO.

If your microfinance organization or family accounting business doesn’t have capacity to spare for ongoing content production, consider outsourcing it to a specialist who can ensure content accuracy and depth. Alternatively, enlist their help to develop a library of educational resources that position your business as a local authority in your area of expertise.

H&R Block is a U.S. tax service company that has a very informative online library.

Seasonal and economic fluctuations

Financial services providers are heavily affected by economic and seasonal trends. Wealth management firms are in great demand during periods of high market volatility, when clients seek advice on protecting their assets. Accounting firms providing tax preparation services are the busiest during tax season, January to April. Real estate and mortgage activities slow down during the winter holidays and peak during spring and summer, as most families prefer to move when school is out.

If your local business also experiences fluctuations in demand, whether seasonally or following market cycles, your best bet is to stay informed and plan ahead. Monitor economic trends and adjust your content and local SEO strategies to stay relevant. Create content that addresses seasonal financial concerns, such as tax preparation tips in tax season or investment strategies during times of uncertainty. Also, be sure to maintain a fully optimized local SEOpresence at all times, as it is through this practice that you can ensure you’ll be found by prospective clients whatever the season.

Dependence on quality backlinks

To gain the trust of prospects and search engines, financial services businesses need backlinks from highly authoritative and relevant sites, such as educational institutions, government organizations, and industry publications. These are harder to obtain than the standard backlinks from local business directories or news sites that other local businesses might target.

There’s no magic formula here. You will need to build robust relationships with local businesses, chambers of commerce, and community organizations to gain valuable backlinks. In addition, stay active on the local scene: sponsor events, foster collaborations, or engage in initiatives—all of which can lead to mentions and backlinks from local websites.

Four must-have Semrush Local features for your financial services business

All your client reviews at a glance